ハイパーインフレ(超円安)に対処できる最強のものが知りたいです。

個人ができるハイパーインフレ(超円安)に対処できる最強のものは”米ドル”です。

それもドル建ての金融商品を持つよりも、米ドルと連動(ペッグ)している仮想通貨のステーブルコイン(USDT・USDC・DAI)が最強です。

「1ドル=1USDT・1ドル=1USD C・1ドル=1DAI」なので、ほぼ、米ドルに投資すると思ってもらって大丈夫です。

ステーブルコインとは?

安定した価格を実現さるために米ドルなどと連動(ペッグ)するように設計された暗号資産です。

- この記事を書いた人

たなかのプロフィール

- 【経歴】

投資歴 (10年目)仮想通貨歴(5年目) - 【保有資格】

日本証券協会 外務員資格 - 【お金の流儀の運営】

初心者向けに仮想通貨(暗号資産)・DeFi・NFT・お金・ブログの情報発信

仮想通貨やDeFi(レンディング)で7桁の運用

まず、円安(インフレ)対策の基本は資産(日本円)の半分(50%)を米ドルにすることです。

そうすれば、あなたの資産は円安(インフレ)や円高(デフレ)の影響を一切受けません。

意外と簡単ですよね?

後は「日本円と米ドルの割合をどうするのか?米ドルをどこで持つか?攻めのポートフォリオか?守りのポートフォリオか?」をあなたが決める必要があります。

まず、一つ言えることはハイパーインフレ(超円安)対策を本気でしたいなら、資産の半分(50%)以上を日本円にすることはやめて下さいね。

円安(インフレ)が進めば進むほどあなたの資産は目減りしていきますから...

また、投資は自己責任なので本記事で得た知識をヒントにあなた自身がポートフォリオを考えてこの最悪の局面を乗り越えていきましょう。

そして仮想通貨を始めるには国内取引所が必要になってきます。

先に全取扱通貨が500円から購入可能なコインチェックで口座開設〜入金まで済ませておきましょう。

\最短5分で口座開設/

ハイパーインフレ(超円安)に対処できる最強のもの

ハイパーインフレ(超円安)に対処できる最強のものランキング

【1位】仮想通貨

【2位】海外口座

【3位】米国債・米国株・米国投資信託

【1位】仮想通貨

【メリット】

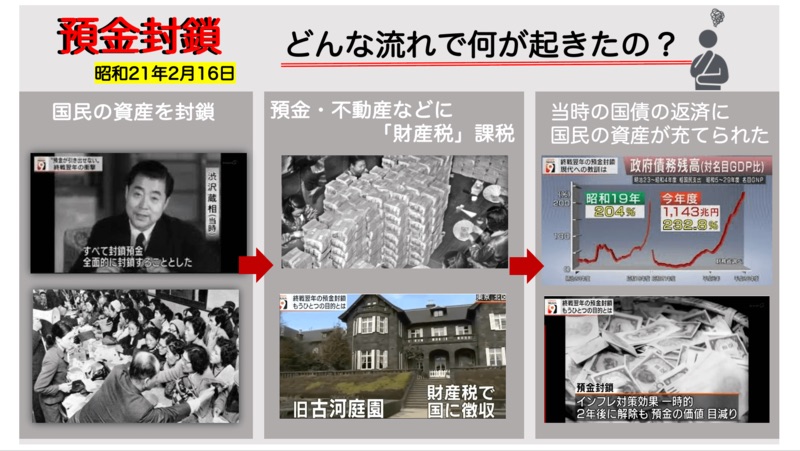

ステーブルコインで預金封鎖と円安(インフレ)対策できる

【デメリット】

ステーブルコインを買うのが少し複雑

ハイパーインフレ(超円安)対策としては仮想通貨のステーブルコイン(USDT・USDC・DAI)が「最強のもの=No1」です。

なぜなら、ステーブルコインであれば単にハイパーインフレ(超円安)対策だけではなく預金封鎖対策にもなり、個人が簡単に米ドルを売買できるからです。

日本の金融機関(銀行・証券・保険)を通して金融商品を買ってもハイパーインフレ(超円安)になる前に預金封鎖されたら本末転倒ですから...

ステーブルコイン以外にも日本人が米ドルを持つには「米国株・米国債・投資信託」などがありますが、折角米ドルを持っててもその金融商品自体が下がってしまえば元も子もないです。

そこで米ドルに連動したステーブルコイン(USDT・USDC・DAI)の活躍です。

ステーブルコインで米ドルを持ち、さらにステーブルコインをレンディング(貸出し)で年利8%で運用することで、運用利回り(年利8%)+為替差益でハイパーインフレ(超円安)対策になります。

むしろ、ハイパーインフレ(超円安)になるとあなたの資産は増えていきます。

さらに、ステーブルコインは流動性も高くいつでも日本円に換金できます。

仮想通貨の始め方

①コインチェックの口座開設

②Binanceの口座開設

③コインチェックでリップルを買ってBinanceに送金

④リップルでステーブルコイン(USDT・USDC・DAI)を買う

⑤Bit Lendingでレンディング

①コインチェックの口座開設

まずはコインチェック公式サイトにログインして口座開設します。(最短5分で口座開設できます)

口座開設完了後に「ウォレット」をクリック⇨「日本円」をクリック⇨「入金」をクリック⇨「銀行入金」で入金します。

②Binanceの口座開設

③コインチェックでリップルを買ってBinanceに送金

コインチェックでリップルを買ってBit Lendingに送金します。

リップルを買う理由はビットコインやイーサアムよりも送金手数料が格安だからです。

コインチェックでリップルを買ってBit Lendingに送金する方法はこちら>

④リップルでステーブルコイン(USDT・USDC・DAI)を買う

リップルでステーブルコイン(USDT・USDC・DAI)を買います。

⑤Bit Lendingでレンディング

Bit Lendingでビットコインをレンディングします。

【2位】海外口座

【メリット】

海外口座で預金封鎖対策ができて米ドルを保有できる

【デメリット】

口座開設費用がかかる

資金に余力がある方は海外口座を作って米ドルで預金するのも一つの方法でしょう。

昔と違って今はオンラインで口座開設費を払うだけで口座開設できます。

海外口座の入門としては口座開設費用が800ドルと最安値のTrident Wallet(JDB銀行)の口座開設するのがおすすめです。

Trident Wallet(JDB銀行)のメリット

①高金利預金

②預金封鎖対策

③各種手数料が安い

④口座開設費用が安い

⑤日本にいながらオンラインで海外口座の口座開設できる

-

Trident Wallet(JDB銀行)を他銀行と徹底比較

続きを見る

【3位】米国債・米国株・米国投資信託

【メリット】

簡単に始められる

【デメリット】

金融商品自体のボラティリティーがあり、預金封鎖対策にはならない

米国債

米国債とは?

米国債(米国財務省証券)はアメリカ合衆国財務省証券が発行する国債です。

米国政府が利子や元本の償還を行うため、世界で最も信用力の高い金融商品と言えます。

米国債は3つの対策の中でもローリスクローリターンで安定した運用ができます。

なぜなら、米国債は利回りが約束されているので、安定したハイパーインフレ(超円安)対策できます。

さらに、米国債の利回りは2019年7月から2022年1月まで年利1~2%を推移していましたが、2022年10月頃から年利4%の高利回りになってきました。

米国株

米国株は3つの対策の中でもハイリスクハイリターンな運用ができます。

例えばMETAでさえここ半年で50%近く下落しており、METAだけでなく、GAFAM(Google、Amazon、Facebook(META)、Apple、Microsoft)の株価も軒並み下落しています。

もちろん、これらの銘柄は将来的には値上がりする可能性が高い銘柄ですが含み損が続くと現金化できない弊害が出てきます。

米国投資信託

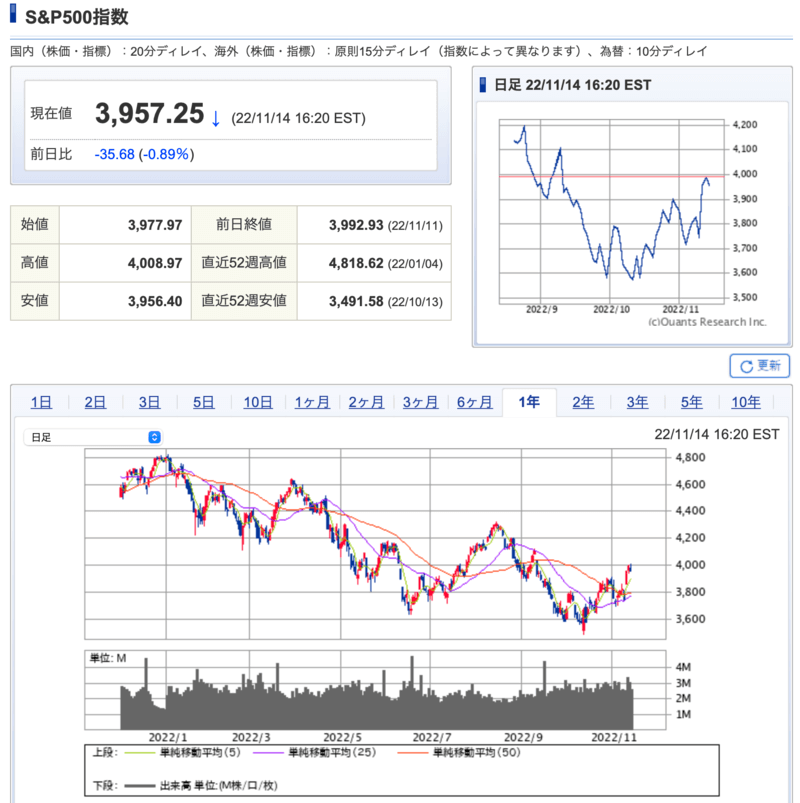

S&P500とは?

S&P500はニューヨーク証券取引所やNASDAQなどに上場している代表的な500銘柄の時価総額で加重平均した指数に連動するインデックスファンドです。

米国投資信託は3つの対策の中でもミドルリスクミドルリターンな運用ができます。

例えば人気の米国の代表的な株式指数のS&P500も米国のCPI(消費者物価指数)の影響で2022年6月中旬には20%以上暴落している状況です。

022年6月のCPIは9.1%の上昇となり、約40年ぶりのインフレでCPIが2~3%に落ち着けばS&P500も安定するでしょう。

このように、いくら米ドル建の金融商品を持っていても、インフレ(円安)の影響を受けてしまったら意味がないのです。

米国債・米国株・米国投資信託の買い方

米国債・米国株・米国投資信託はSBI証券で買うことができます。

ハイパーインフレとは?

ハイパーインフレの定義

ハイパーインフレの前にインフレとデフレの復習から始めます。

インフレ(インフレーション)とは?

物価が継続的に上昇する状態で、通貨の価値は下がります。

デフレ(デフレーション)とは?

物価が継続的に下落する状態をいい、通貨の価値が上がります。

ハイパーインフレの定義は国際会計基準では「3年間累計で100%(年率 26%)以上の物価上昇」と言われています。

経済学者フィリップ・ケーガン氏が1956年の論文の定義は「毎月に50%以上のインフレーションが起きている状態」です。

インフレ・デフレ・ハイパーインフレについて動画で学びたい方はこちら⇩

ハイパーインフレが起きた国

ハイパーインフレが起きた国

・1923年ドイツのハイパーインフレ

・1945年日本のハイパーインフレ

・1992年ロシアのハイパーインフレ

・2008年ジンバブエのハイパーインフレ

・2013年ベネズエラのハイパーインフレ

1923年ドイツのハイパーインフレ

ドイツは1923年の第一次世界大戦敗戦後の莫大な賠償金を払えずに、紙幣を刷りまくって賠償金の返済に充てました。

その結果、通貨の価値が大暴落してハイパーインフレになりました。

1945年日本のハイパーインフレ

日本は1945年の第二次世界大戦敗戦後に年率70倍、1949年までには年率220倍のハイパーインフレになりました。

1946年には預金封鎖+財産税で政府は財政を立て直しました。

1992年ロシアのハイパーインフレ

1991年のソ連崩壊後にロシアは配給制を廃止したのが原因で、1992年に年率2150%のハイパーインフレになりました。

1996年にはIMFの融資・指導の結果インフレは収束しました。

2008年ジンバブエのハイパーインフレ

ジンバブエは2000年頃からインフレを起こしており、国の借金を量的緩和で賄っていました。

その結果、通貨の価値が大暴落して年率2億%を超えるハイパーインフレになりました。

ハイパーインフレによってジンバブエドルは2009年4月12日に廃止されました。

2018年ベネズエラのハイパーインフレ

ベネズエラは2008年のリーマンショックと2014年のシェールショックが原因でハイパーインフレに陥りました。

2018年にはインフレ率が年率13万%を記録して以来現在までハイパーインフレが続いています。

日本でハイパーインフレ(超円安)が起きる理由

日本でハイパーインフレ(超円安)が起きる理由

①日米の金利差

②日本の借金の量

①日米の金利差

米国の中央銀行のFRB(連邦準備制度理事会)は2022年3月から金融緩和を辞めて金利の引き上げを始めました。

2022年の日本と米国の金利差を表にして見ると一目瞭然です。

| 2022年 | 1月 | 2月 | 3月 | 4月 | 5月 | 6月 | 7月 | 8月 | 9月 | 10月 | 11月 | 12月 |

| 日本 | −0.10 | −0.10 | −0.10 | −0.10 | −0.10 | −0.10 | −0.10 | −0.10 | −0.10 | −0.10 | −0.10 | −0.10 |

| 米国 | 0.25 | 0.25 | 0.5 | 0.5 | 1.0 | 1.75 | 2.50 | 2.50 | 3.25 | 3.25 | 4.00 | 4.50 |

一方、日本の中央銀行に当たる日銀(日本銀行)は政府のインフレ率2%の達成ができても金融緩和を継続しています。

というか、金融緩和を辞めれない理由があります...

それは日本の借金の量です。

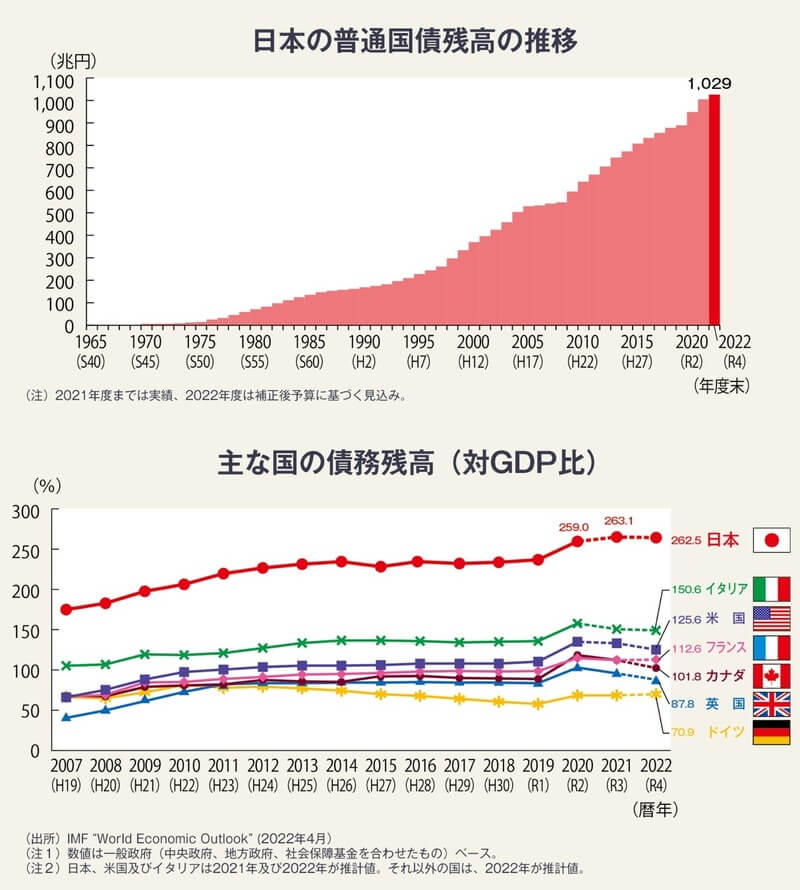

②日本の借金の量

日本の政府債務残高は2022年度末で1,029兆円とGDP比の2倍を超えており、世界最悪の借金国です。

そのため、米国と同じように利上げすれば日銀が保有している日本国債が含み損になり日銀が債務超過に陥るからです。

日銀が債務超過に陥れば日銀が発行する円は世界中から信用がなくなり円が大暴落します。

これは過去にハイパーインフレが起きた国の歴史から学べば理解できるでしょう。

円が大暴落すればお金の価値がなくなるので、一気にハイパーインフレ(超円安)になります。

それでも日本はハイパーインフレにならないだったり可能性がないと思うなら米ドルではなく日本円を持ち続けて下さい。

さらに詳しく動画で学びたい方はこちら⇩

ハイパーインフレ(超円安)に対処できる最強のものの良くある質問

ハイパーインフレ(超円安)に対処できる最強のものの良くある質問

①日本でハイパーインフレ(超円安)はいつ起きる?

②ハイパーインフレ(超円安)に備える備蓄リストは?

③ハイパーインフレ(超円安)対策のポートフォリオは?

④ハイパーインフレ(超円安)になれば住宅ローンがチャラになる?

①日本でハイパーインフレ(超円安)はいつ起きる?

いつ起きるのかを予測することはかなり難しいですが、日本はいつ起きてもおかしくない状況です。

さらに、ハイパーインフレ(超円安)対策はもちろんのこと預金封鎖対策も合わせてするのが最強です⇩

-

【最新版】2024年までに起こる『預金封鎖』対策3選

続きを見る

②ハイパーインフレ(超円安)に備える備蓄リストは?

資産の50%以上を米ドルにしておけば備蓄リストは必要ないです。

無駄に備蓄リストの商品を買うくらいなら米ドルにしておきましょう。

③ハイパーインフレ(超円安)対策のポートフォリオは?

まず、ハイパーインフレに強い資産の代表は米ドルです。

冒頭でもお伝えしましたが、日本円50%でステーブルコイン(USDT・USDC・DAI)50%にすればハイパーインフレ(超円安)の影響は全く受けないです。

逆に、ハイパーインフレ(超円安)が起きた際に儲けるには日本円の割合を減らしてステーブルコイン(USDT・USDC・DAI)の割合を増やせばいいのです。

さらに、リスクを背負ってでも儲けたいならステーブルコインだけでなく、ビットコインをポートフォリオに組み込めばいいでしょう。

ビットコインをガチホしていて円が暴落すればビットコインの価格は必然的に上がっていきます。

現在価格はこちら⇩

さらに、ビットコインは機関投資家などから以下の価格予想が出ています。

ビットコインの価格予想

①アーク・インベストメント・マネジメントは2030年までに約1億1000万円を超えと予想

②planBは2030年までに約1.2億円を超えと予想

③ピーターティールは現在の価格から100倍の約5.6億円と予想

現在冬の時代に突入しているビットコインを買っておけばビットコイン自体の値上がりによってあなたの資産は円安(インフレ)の影響を受けるどころか増えていくでしょう。

-

【初心者必見】なぜビットコインの将来価格は2030年までに1億円になるのか?

続きを見る

④ハイパーインフレになれば住宅ローンがチャラになる?

チャラになるどころか逆に苦しくなます。

これは、基本的なことなので復習しておきましょう。

住宅ローンを組む時に固定金利よりも金利が安い変動金利にした人は固定金利にした方が良いかもしれません。

それこそハイパーインフレになれば金利は上がるので変動金利の場合は利息制限法の上限金利(借入額100万円以上は15%)まで金利が上がります。

円安・インフレと円高・デフレとは?

円安・インフレ(物価が高い)⇨金利上昇

円高・デフレ(物価が安い)⇨金利低下

さらに、一般的な銀行が提供する住宅ローンはハイパーインフレ対策として例外条項があるので注意が必要です。

具体例として、楽天銀行の楽天銀行住宅ローン(金利選択型)約款を見てみましょう⇩

第5条 固定金利の適用

「出典元:https://www.rakuten-bank.co.jp/rules/hl.html」

(中略)

1.(3)当行は金融情勢の変化その他相当の事由があると認められる場合には、基準金利の算出方法を合理的と判断される他の方法に変更することができるものとします。

また、他の方法から更に別の他の方法へ変更する場合についても同様とします。

ハイパーインフレは「金融情勢の変化その他相当の事由」に該当するので、固定金利の金利以上に金利上昇する可能性が高いです。

最も確実な住宅ローンのハイパーインフレ対策としてはARUHIフラット35が最適です。

ARUHIフラット35の住宅ローン債権は証券化されているのでハイパーインフレのリスクは住宅支援機構とARUHIではなく投資家に転化されているからです。

ハイパーインフレ(超円安)に対処できる最強のものまとめ

本記事では個人ができるハイパーインフレ(超円安)に対処できる最強のものを解説しました。

もはや、円安(インフレ)がさらに進んでいく日本人にはハイパーインフレ(超円安)対策は必須と言えます。

まずは簡単に取引できる仮想通貨できるハイパーインフレ(超円安)対策をしていきましょう。

【お問い合わせについて】

ハイパーインフレ(超円安)について質問がある方は、お問い合わせよりご連絡頂ければ対応させて頂きます。

\最短5分で口座開設/

コインチェックの口座開設〜入金方法まで画像付きの解説が必要な方はこちら⇩

-

【最短5分】コインチェックの口座開設方法を3ステップで解説

続きを見る

暗号資産の送金手数料無料のGMOコインと他社取引所を比較した記事はこちら⇩

-

【暗号資産の送金手数料無料】GMOコインの口座開設方法を3ステップで解説

続きを見る

僕がBit Lendingで200万円分のビットコインを年利8%でレンディングしている体験談はこちら⇩

-

【200万円貸出し】BitLending(ビットレンディング)は怪しい?評判は?

続きを見る