友達に紹介されたFP(ファイナンシャルプランナー)からITA(インベスターズトラスト)のS&P500を勧誘されていますがやばいですか?

一概にやばいかどうかはお答えできません。

なぜなら人によって条件(積立金額・年数・年齢・年収・資産)が異なるからです。

- この記事を書いた人

たなかのプロフィール

- 【経歴】

投資歴 (10年目)仮想通貨歴(5年目) - 【保有資格】

日本証券協会 外務員資格 - 【お金の流儀の運営】

初心者向けに仮想通貨(暗号資産)・DeFi・NFT・お金・ブログの情報発信

仮想通貨やDeFi(レンディング)で7桁の運用

僕自身は2020年〜2022年までITA(インベスターズトラスト)の正規代理店(いわゆる紹介者)として活動しつつ、僕自身もEvolution(エボリューション)に毎月600ドル積立投資していました。

2022年現在は初期口座が終わったタイミングで積立を停止しています。

積立を停止した理由はEvolutionで毎月600ドル積立投資を25年するなら、「ビットコインに毎月600ドル積立投資を25年した方が早く資産が増やせると判断した」からです。

そんな僕がこの記事を書こうと思ったきっかけとしてITA(インベスターズトラスト)とググってみると...

違法や詐欺など批判意見の記事の大半は当事者自身がやっていないにも関わらず、「それっぽく、情報をまとめている」そういったものばかりで気分が悪かったからです。

ちなみに、投資家はその記事や人物の信憑性として「ITA(インベスターズトラスト)に積立投資していたり、正規代理店の経験があるのか?」は必ず確認すべきです。

そこで、経験者だからこそ発信できる情報には社会的公益性があると思いこの記事を書くことにしました。

本記事ではITA(インベスターズトラスト)に契約するべきか悩んでいる方が決断できるように、元正規代理店の僕がFPが絶対に言われたくないデメリットもメリットも全て暴露していきます。

【注意事項】

本記事はITA(インベスターズトラスト)を肯定も否定もしません。

もちろん、ITA(インベスターズトラスト)で積立投資するor積立投資しないは″必ず投資家であるあなた″が意思決定して下さい。

投資の世界で〇〇さんが薦めたたから損したといった他責は一切通用しません。

個人的には無理しない金額でビットコイン投資がおすすめです。(これは現在僕自身が投資しているのでおすすめしています)

先に全取扱通貨が500円から購入可能なコインチェックで口座開設〜入金まで済ませておきましょう。

\最短5分で口座開設/

海外オフショア投資で重要なポイントは?

海外オフショア投資をする上で重要なことは金融商品の手数料です。

具体的には表面利回り(グロス)ではなく、実質手数料(ネット)で見ることが大事です。

なぜなら同じような表面利回りの場合には最も『手数料が安い会社』を選択した方が実質利回りが高くなるからです。

年間利回りの公式

ネット:表面利回り(%)= (単純な収益/投資元本)×100

グロス:実質利回り(%)=((単純な収益−手数料)/投資元本)×100

海外オフショア投資の利回りは手数料を引いた実質手数料(ネット)ではなく、表面利回り(グロス)でFPから説明を受けることが多く、ここに気づかないで高い手数料のまま投資していたら思わぬ損失になります。

金融教育に乏しい日本人は投資詐欺に合いやすいので注意が必要です。

海外オフショア投資の否定的なブログ記事にあるのですが、そもそも海外オフショア投資の表面利回りが高い低いと比較しても意味がないんです。

なぜか?それは勧誘しているFPの予想の表面利回り(意地悪な言い方するとFPの妄想)だからです。

【重要事項】

勧誘しているFPが提示している表面利回りはあくまでこれまでの実績からの予測であり不確実な表面利回りです。

そもそもファンドの20年や25年後の表面利回りなんて誰も当てることはできないのですから比較すること自体が事態ナンセンスです。

そんな不確実な表面利回りを議論するよりも重要なことは『何度も言いますが手数料』です!!!

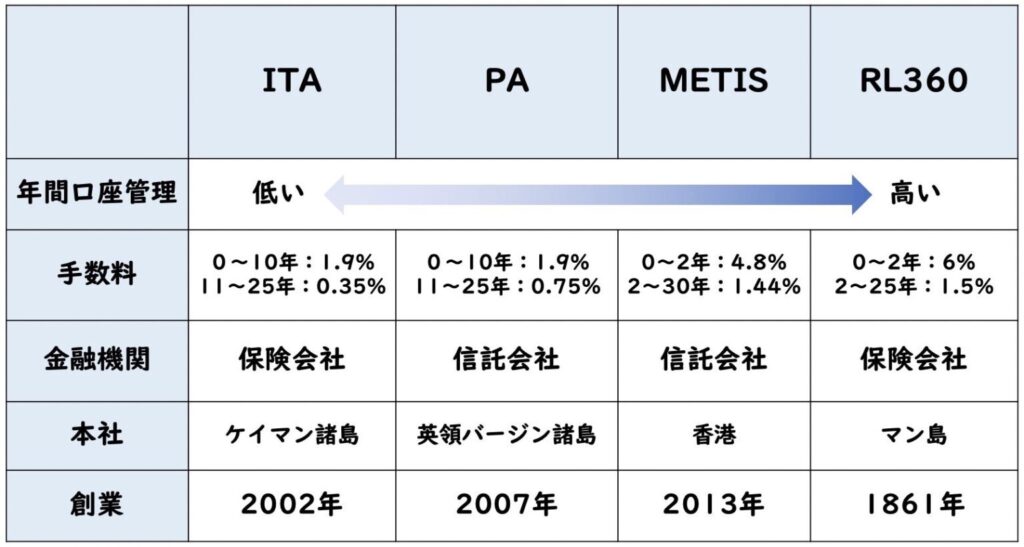

金融機関別手数料比較

上記の表を見ればわかる通りITAの手数料が代表的なオフショアファンド4社の中で圧倒的に安いです。

だから僕は手数料が安いITAを選びました。

特にRL360(ロイヤルロンドン)は手数料が圧倒的に高いことは一目瞭然です。

RL360(ロイヤルロンドン)を選ばれている方は歴史で選択されている人が多い印象ですね。

僕は圧倒的に『手数料』をみていますが、個人によって価値観は多く異なるということでしょう。

ITA(インベスターズトラスト)とは?

ITAグループ会社概要

設立は2002年でケイマン諸島に籍をおく、金融機関(保険会社)です。

預かり資産:約15兆ドル、7カ国に拠点を持ち世界100カ国以上でビジネスを展開しています。

ITAの特徴

①日本からオンラインで申し込み可

(海外に渡航して契約する必要なし、書類郵送の時間と手間を省略できる)

②クレジットカード手数料無料

(JCB、AMEXを含む様々なクレジットカードで毎月自動積立)

③日本語サポート完備

(日本語ウェブサイトで自身の運用益や契約状況等の確認・変更が可能)

下記はITAの公式サイトです⇩

金融機関の安全性とは?

ITAは倒産しないのですか?

なるほどですね!

保険会社の安全性は気になりますよね。

投資家のために保険会社のデフォルトリスクを客観的に判断する指標として『格付け』があります。

格付けとは言わば『金融機関の偏差値』です。

その金融機関が信用できるか?どうかはこの格付け=偏差値によって判断すべきなのです。

AMベスト社《米》とは?

1899年に創立。保険会社「財務健全度格付けFinancial Strength

Rating」や「債券格付Debt Ratings」を行っている。

保険・社専門の格付け機関。S&PやMoody’sよりも厳しい基準を設けており、アメリカの保険会社はAM Bestの格付け取得が必須となっている。

http://www.ambest.com/home/default.aspx

AMベスト社の評価において、日本の保険会社の格付けは下記の通り⇩

・明治安田生命:A-

・第一生命:A+

・三井住友火災海上保険:A+

・東京海上日動:A++

2002年設立の新興の金融機関であるITAが日本の老舗の大企業と近しい格付けを受けて、評価されています。

AMベスト社の格付けで『A−』の評価を受けています。

ITAの顧客資産はHSBC NY支店に着金し、そこから分離口座にて管理され法律上ITA社債等から『100%分離保護』されています。

ITAが仮にデフォルトしても顧客の資産は別の銀行で保護されているということです。

そもそも、ITAはファンドではありません。

『投資家のお金を預かったり、その資金を運用していません』からITAが倒産したとしても、全く影響がありません。

ITA自体に利回りは存在しない

ITAは『保険会社』で、そもそも運用をしている会社ではありません。

そのため、利回りという概念がありません。

IFA (運用会社)という外部の会社が運用を担っています。

Evolution(アクティブファンド)の運用成績は各IFA(運用会社)のポートフォリオマネージャーの腕にかかっています。

なのでITAを同じ時期に同じプラン・金額で始めたとしても選択しているIFA(運用会社)が違うと全く違う利回りになるので比較なんてできないのです。

インデックスファンドとは?

S&P500や日経平均などの株価指数に連動する投資信託です。

アクティブファンドとは?

ポートフォリオマネージャーが指数を上回ることを目標として、投資商品を選択・運用する投資信託。

積立プラン

初期口座期間

初期口座期間は積立の減額、停止すると解約返戻金がありません。さらに、引き出しもできません。

【初期口座期間】

S&P500の20年プランだと28ヶ月

Evolutionの25年プランだと24ヶ月

満期受け取りまでは何があっても積立ができる金額で契約することがとても大切ですね。

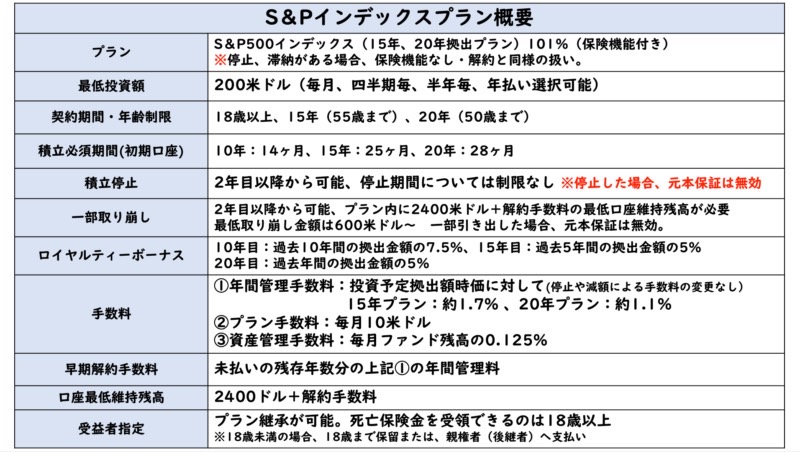

S&P500(インデックス)

S&P500インデックスプランの概要

プランの仕組み

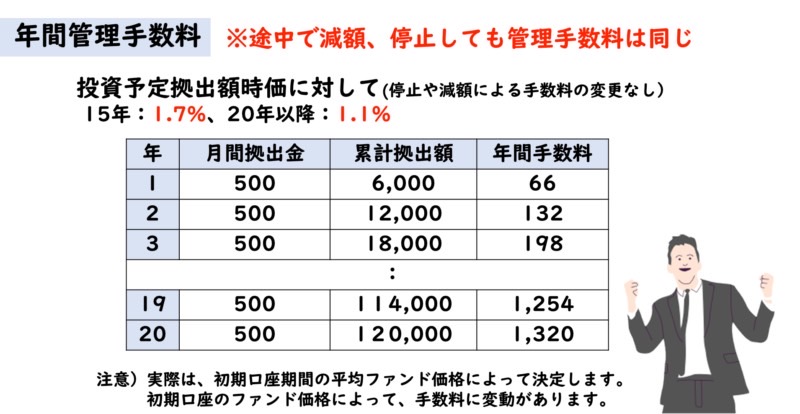

年間手数料

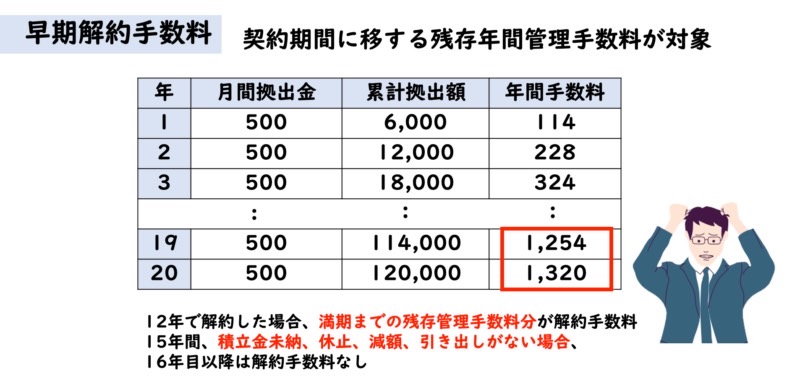

早期解約手数料

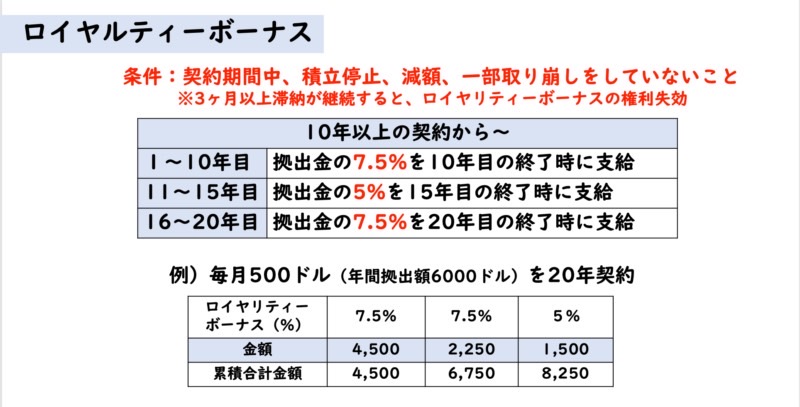

ロイヤリティーボーナス

詳細はITA(インベスターズトラスト)の公式サイトより⇩

Evolution (アクティブファンド)

Evolutionプランの概要

プランの仕組み

仕組み-1024x573.jpg)

年間管理手数料

早期解約手数料

アロケーションボーナス

詳細については公式サイトをご確認ください⇩

実質手数料一覧

上記のようなプラン情報はITAの公式ホームページを見れば出てきます。

ぶっちゃけ、皆さんの理解は追いついていますか…?

正直なところ、良く分からないんじゃないかなと思います。

そこで、僕が実質手数料を計算して下記にまとめました!

※僕がググった限り公式の手数料一覧はまとめていても、実質手数料をまとめている記事はなかったので割と有益かなと。

実質手数料.jpg)

実質手数料 -1024x500.jpg)

上記の表にはロイヤルティボーナスは含んでいません。

途中で積立の取崩し、減額、遅滞、停止をするとロイヤルティボーナスはなくなります。

積立プランのメリット・デメリットまとめ

さすがに手数料を考えるとITAは600ドル以上で契約したいのですが、20年以上も続けられる自信がないです。

それならコインチェックで少額の500円からビットコインを購入してみてはいかがでしょうか?

現在仮想通貨市場は冬の時代なので、かなり安く買えます⇩

当たり前ですが、コインチェックには初期口座なんてないので(笑)

さらに、機関投資家や資産家が「2030年までに1BTC=1億円」と予測されています⇩

-

【最新考察】なぜビットコインの価格は将来1億円になるのか?

続きを見る

仮想通貨の始め方

ビットコインを買って2025年までガチホしているだけでは残念ながらビットコインの枚数は増えません。

そこで、買ったビットコインの一部でもBit Lendingでレンディング(貸出)して年利8%で運用するのがおすすめです。

仮想通貨の始め方

①国内取引所の口座開設

②国内取引所でビットコインを買ってBit Lendingに送金

③Bit Lendingでレンディング

①国内取引所の口座開設

まずはコインチェック公式サイトにログインして口座開設します。(最短5分で口座開設できます)

口座開設完了後に「ウォレット」をクリック⇨「日本円」をクリック⇨「入金」をクリック⇨「銀行入金」で入金します。

②国内取引所でビットコインを買ってBit Lendingに送金

国内取引所でビットコインを買ってBit Lendingに送金します。

コインチェックでビットコインを買ってBinanceに送金する方法はこちら>

③Bit Lendingでレンディング

Bit Lendingでビットコインをレンディングします。

ITA(インベスターズトラスト)は違法?

外為法(外国為替及び外国貿易法)の改正

これまで日本人は海外金融機関との取引は禁止されてました。

しかし、1998年に金融ビッグバンで『外為法の改正』がされ日本人が海外投資を行うことは自由化されました。

改正された背景には外圧など様々な要因がありますが、法律を作る側の人間のために行われたという説もあります。

つまりは政治家や官僚などの富裕層たちが、日本の国家破産に対する資産のキャピタルフライト(海外移転)を合法化するためではないかと言われております。

20年以上も前からいち早く資産のキャピタルフライトをしている政治家や官僚がいると思うとゾッとしますね。

ITAは直接海外の保険会社に投資するので、いわゆる預金封鎖対策としては最適です⇩

-

【最新版】2024年までに起こる『預金封鎖』対策3選

続きを見る

保険業法186条

日本人が外国の保険会社と保険契約をすることは保険業法第186条で実質禁止されており、保険業法第337条で保険契約の申込をすると加入者が50万円以下の過料が課せられます。

保険業法第186条(日本に支店等を設けない外国保険業者等)

2.

日本に支店等を設けない外国保険業者に対して日本に住所若しくは居所を有する人若しくは日本に所在する財産又は日本国籍を有する船舶若しくは航空機に係る保険契 約の申込みをしようとする者は、当該申込みを行う時までに、内閣府令で定めるところにより、内閣総理大臣の許可を受けなければならない。

3.五

当該保険契約を締結することにより、日本における保険業の健全な発展に悪影響を及ぼし、又は公益を害するおそれがあること。保険業法第337条

「出典元:http://www.nn.em-net.ne.jp/~s-iwk/current/hou/a186.html」

次の各号のいずれかに該当する者は、50万円以下の過料に処する。

一

第186条第2項の規定に違反して、許可を受けないで同項に規定する保険契約の申込みをした者

「出典元:http://www.nn.em-net.ne.jp/~s-iwk/current/hou/a337.html」

一方で、『保険商品の加入が禁止』なのであって『保険会社と契約することが禁止されているのではない』です。

海外には日本の保険と同じ補償で価格が安いものがあります。

海外の保険に加入できるようになると『日本の保険会社は成り立たなくなってしまいます。』

ITAの商品は『保険商品ではなく、投資商品なのです』。

ITAを契約することでの保険業法による罰則はありません。

無登録業者

日本で金融商品の営業は本来、資格や登録のあるものしか、代理・媒介することができません。

ですが、『海外ものを代理・媒介する資格等』はそもそも、日本には存在しません!

希望する者は海外の投資商品を契約可能

海外業者は日本国内での営業活動不可

金融庁のベージにも無登録で金融商品取引業を行うものの一覧に、オフショアファンドの業者名はありません。

金融庁のサイトは下記より⇩

海外オフショア投資の代理店とは?

ITA(インベスターズトラスト)は完全紹介制です。

直接ITA(インベスターズトラスト)に連絡しても契約することはできません。

希望者は申し込み手続きができる正規代理店登録されているFP(ファイナンシャルプランナー)に依頼する必要があります。

注意したい悪徳代理店の3つの特徴

①無登録業者にも関わらず、有料相談をおこなっている業者

②金融商品取引法(第38条1号・2号)の違反業者

③無資格者にも関わらず、代理店業務を行なっている者

①無登録業者にも関わらず、有料相談をおこなっている業者

投資に関するアドバイス(助言)を有料で行っていもいいのは、『投資助言代理業』の登録をしている業者だけです。なので、コンサル料などで代金を取ろうとする業者に出会ったら、必ず『投資助言代理業』の登録の有無を問いただしてください。無登録の場合は「無登録助言」となって金融商品取引法に抵触しますので違法業者です。

②金融商品取引法(第38条1号・2号)の違反業者

金融商品取引業者が、『絶対儲かります』『絶対利益を出せます』というように値上がりを期待させるような勧誘は禁止されています。利回りは断定できるものではありません。

【よくある勧誘ワード】

オフショアファンドであれば、絶対に年間利回り10%以上になりますよ。

なので、6万円を25年間投資したら、7961万円になりますね。

資産運用シュミレーション:https://www.fsa.go.jp/policy/nisa2/moneyplan_sim/index.html

このように、『絶対年間利回り10%以上になります』というような『〜は確実である』と誤認させるように告げて勧誘することは『断定的判断の提供』があったとして『金融商品取引法(第38条1号・2号)違法』となります。

【例】

4%の実質利回りなら〇〇〇〇万円くらいの運用益です。

8%の実質利回りなら〇〇〇〇万円くらいの運用益です。

12%の実質利回りなら〇〇〇〇万円くらいの運用益です。

と答えてくれる代理店が良心的と言えるでしょう。

何度も言いますが、『利回りは確実性は無く、確実に断言できるのは手数料だけ』です。

③無資格者にも関わらず、代理店業務を行なっている者

最低限、きちんと代理店登録をされている紹介者から説明を受けるようにしましょう。

金融商品を紹介している人の中には、『金融に関わる資格』を取得していない方もいます。

資格の有無と本人が『正規代理店』であるかは、必ず確認しておきたいですね。

「証券外務員」「ファイナンシャルプランニング技能士」など有資格者から話を聞くようにした方が良いです。

ちなみに、ITAは「証券外務員」や「ファイナンシャルプランニング技能士」など有資格者でなければ正規代理店登録不可です。

ITA(インベスターズトラスト)のまとめ

冒頭でもいいましたが、ITA(インベスターズトラスト)で積立投資するor積立投資しないは″必ず投資家であるあなた″が意思決定して下さい。

S&P500インデックスプランの実質手数料まとめ

| 積立金額(ドル) | 実質手数料 |

| 200 | ー6.1% |

| 300 | ー4.4% |

| 450 | ー3.3% |

| 600 | ー2.7% |

| 1125 | ー1.9% |

S&P500インデックスプランは20年満期で160%の元本保証があるので高額の手数料です。

この高額の手数料を払ってまで、160%の元本保証が欲しいのか?で検討してみてはいかがでしょうか?

(独り言)

Evolutionの初期口座~10年目までの実質手数料まとめ

| 積立金額(ドル) | 実質手数料 |

| 200 | ー5.4% |

| 300 | ー3.2% |

| 450 | ー1.5% |

| 600 | ±0% |

| 1125 | +1.5% |

Evolutionの11~25年目までの実質手数料まとめ

| 積立金額(ドル) | 実質手数料 |

| 200 | ー3.85% |

| 300 | ー1.65% |

| 450 | ー0.05% |

| 600 | +1.55% |

| 1125 | +3.05% |

Evolutionの200ドルor300ドルor450ドルだと高額の手数料です。

さらに、アクティブファンドでリスクを取っているので、あまりにもハイリスクローリターンではないでしょうか?

Evolutionの600ドルor1125なら手数料が+になります。

ですが、「25年間積立の取崩し、減額、延滞、停止なく積立投資」できてやっとハイリスクミドルリターンではないでしょうか?

(独り言)

僕がEvolutionの積立停止が希望と伝えたところ下記のような注意事項がありました⇩

また、当プランは、取崩し、減額、遅滞、停止なくお積立いただく事で10年経過以降のローヤルティ―ボーナス享受と共に「長期×複利効果」により最大限の運用益を出すことを目指すプランとなっており、更に15年間取崩し、減額、停止、遅滞がございませんと、16年目以降解約手数料が無料となります。

しかしながら、お積立て停止をされますと、上記特権を失うだけではなく、運用資金の増加がない状態で、運用に伴う手数料は継続して発生し(手数料負担率の上昇)、今後運用益を出すことが非常に難しくなりますため、弊社ではお積立停止は推奨しておりません。

そして、運用に伴う手数料の詳細は以下です⇩

①年間管理手数料:投資予定拠出額時価に対して1-10年目=約1.9%、11年目以降=約0.35%(休止や減額による手数料の変更なし)

②プラン手数料 :毎月7米ドル

③資産管理手数料:毎月ファンド残高の0.125%

④JAFI一任マネジメント費:2年目以降、解約手数料分を除く口座時価に対して四半期毎に0.25%

このようにEvolutionは「25年間積立の取崩し、減額、遅滞、停止なく投資し続けなければならない」かなり厳しい条件です。

仮に、ビットコインに投資した場合はどうなるのかみていきましょう。

1BTC=500万が平均取得単価で、5000万円になるだけも10倍のキャピタルゲインです。

さらに、ビットコインをレンディング(貸付)することでAPY(年利)8%のインカムゲインを得ることもできます。

僕はビットコインの本質を理解したら、「Evolutionで25年運用するよりも早くしかも自由に資産を10倍以上にできる」と判断しました。

さらに、今仮想通貨市場は冬の時代でかなり安く買えます。

ビットコインが値上がり前に買っておかないと損しますよ。

\最短5分で口座開設/

コインチェックの口座開設〜入金方法まで画像付きの解説が必要な方はこちら⇩

-

【最短5分】コインチェックの口座開設方法を3ステップで解説

続きを見る

暗号資産の送金手数料無料のGMOコインと他社取引所を比較した記事はこちら⇩

-

【暗号資産の送金手数料無料】GMOコインの口座開設方法を3ステップで解説

続きを見る

僕がBit Lendingで200万円分のビットコインを年利8%でレンディングしている体験談はこちら⇩

-

【200万円貸出し】BitLending(ビットレンディング)は怪しい?評判は?

続きを見る